Did you just get your SpendWell Card by mail? Are you now looking for instructions on how to activate MySpendwell Go Card and use it? Look no more, we are here to help. Go through this guide to find out how to activate SpendWell Card at Myspendwell com go activate card and use it by creating MySpendWell Account login. So, what are you waiting for? Let’s begin.

Table of Contents

Consumers who have ordered or received a MySpendwell Visa card in the mail must complete the activation process before using it. The activation process is straightforward, requiring users to register their cards and log in to the Myspendwell website.

Follow these Spendwell Card Activation procedures if you bought your card at a Dollar General store-

The next step is to click the black Next button if you meet these requirements-

Your account should be set up at myspendwell.com/go activate the card once you’ve completed the above steps. The next step is to log into your account so that your funds can be permanently transferred to this account. When you successfully log in to your account, your card is activated.

SpendWell offers a simple, no-frills bank account that won’t cost you a monthly fee! Once you activated Spendwell via MySpendWell com Go Activate Card you can avail its features

Relevant Read: Complete Guide to check SecureSpend Card Balance

Yes, you are allowed to have multiple Spendwell accounts. There are restrictions. Details can be found in the spendwellTM Cash Back Bank Account Deposit Account Agreement as well as the spendwellTM No Monthly Fee Bank Account Deposit Account Agreement.

Handpicked Relevant Read: Guide to cast Tubi TV to Apple devices

Creating a MySpendWell account is a basic process that can be completed in a couple of simple steps:

What’s Hot- Avail discount on your next purchase with Serve Prepaid Card

To utilize your SpendWell card on the internet, just enter the card data, including the card number, expiry date, and security code, at the checkout page of the online store or site where you need to make a payment. Just make sure to have adequate money on the card to finish the process.

There could be a few reasons why your SpendWell card is being declined, including deficient funds, a cancelled or expired card, erroneous card information entered at checkout, or potential fraud concerns. Contact SpendWell client care to know the reason and resolve the issue.

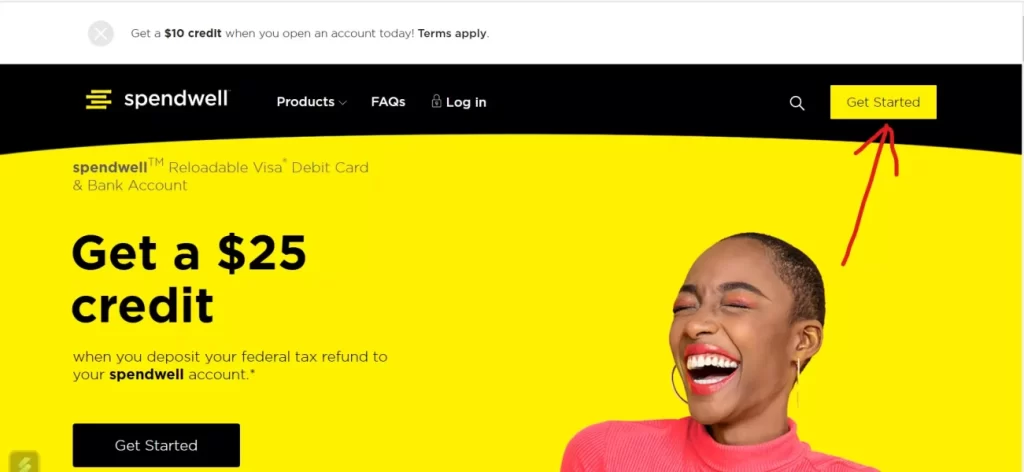

To register for Spendwell, just go to their official website, click on Get Started, and create an account. You can visit Myspendwell.com/go Activate to activate your card

You can use the Unlock option available on the SpendWell card website or app to unlock your card.

That is all there is to it! You’re now you can start using MySpendWell com Go Activate Card to deal with your money and take control of your spending. On the off chance that you experience any issues, you can contact MySpenWell’s customer care.

Published On : July 3, 2023 by: Miti Sharma/Category(s) : Banking & Finance

Leave a Reply