Home » Master Card » How to Apply for OMF Brightway Card: Quick Guide

How to Apply for OMF Brightway Card: Quick Guide

Tired of the huge bills of your Credit Card? Well, you need to give up! Of course not on credit cards but your older ones. There are plenty of credit cards to select in the market. Each card is a better version of the other. Among such plenty of choices, you need not feel disdain anymore. As a matter of fact, you can try the OneMain Financial Brightway Credit cards. These are great credit cards with exciting perks. They can be your next best choice of credit cards. So, hurry up and do Brightway Credit Card apply online (www.meetbrightway.cim/applynow). This is because these are limited edition cards. So, go ahead and do your research!

Things to Know Before you Apply Brightway Credit Card Online

Purchasing a credit card can be very confusing. Especially, when the number of choices is too many. This can be even more head-scratching for new buyers. Hence, you should do good research before purchasing any new product. Here are some of the key points to be kept in mind before you go for Brightway Credit Card Apply online

- APR or Annual Percentage Rate is the price of borrowing allowed on the card. If this is too high as compared to your previous card, you should probably think of moving on. This is the money that you give to the card service. So, go for lesser APR cards.

- The card that you are going to purchase and use in the future should have minimum repayment. This is the minimum amount that you have to pay each month in order to use the card.

- Annual fee. Some cards ask for an annual fee. However, there are some that do not ask for such a fee. So, either go for a card that has no provision for an annual fee or they have a very less annual fee.

- Every card has some limitations. If you go beyond these and use the card, you will be charged by the credit card company. These can occur from offshore payments, late payments, etc.

- Almost all cards provide cash back on making payments. Hence, always choose a card that offers huge cash backs.

- Always check for rewards provided by the credit card company. The rewards can be in the form of cash backs, offers, or even a reduction in interest rates.

Also See: Activate Lowe’s Credit Card

Guide to Apply for OMF Brightway Card

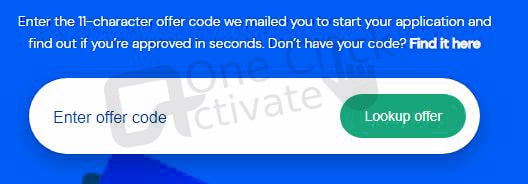

The OMF Brightway cards are available to only a few selected customers. You can easily apply for Brightway card via www.meetbrightway.cim/applynow. So, if you are a customer of OMF then you will be mailed the offer code.

- However, to apply for an OMF Birghtway card the first step is to fill the BrightWay credit card application form and request for the BrightWay credit card.

- Once, you have filled the application form, you will be mailed the offer code, and also the credit card will be sent to you.

- Now, go to the official website of OMF BrightWay credit cards.

- There you will see an option like find my offer. Click on this option to open the application window.

- There you have to enter the offer code and check if you are approved for the credit card or not.

Recommended: Know about Kia Prepaid Card

Difference between BrightWay and BrightWay+ Cards

On OneMain Financial, you will get two credit cards to choose from. The first one is BrightWay and the other is BrightWay+. As a matter of fact, both cards are almost similar. However, they have their own perks too. These features distinguish them. You can apply for both card via www.meetbrightway.cim/applynow. As a matter of fact, BrightWay+ is the upgraded version of BrightWay credit card. Here are some distinct features of both cards. Go through them carefully and make an informed choice.

- The credit limit in BrightWay is $500 whereas the credit limit in BrightWay+ is $3,000. This means that on a BrightWay+ card you can make greater purchases.

- The annual fee limit on a BrightWay card is up to $65 whereas it is $ 0 on a BrightWay+ credit card. This is a great deal if you are choosing a BrightWay+ credit card.

- The purchase APR percentage for both credit cards is the same. It is 26.99% for both credit cards.

- If you are going to decide on unlimited cash back, then this is a key point for you. The unlimited cash back for both BrightWay and BrightWay+ is the same that is 1%.

- In both the cards that is BrightWay and BrightWay+, there is a provision of milestones. One can either get an increase in credit limit or a decrease in APR in less than six months. You will have to simply qualify to claim the rewards.

- The BrightWay card can be later on upgraded to a BrightWay+ credit card. To do so, you will have to clear 4 milestone events.

Also Read: Activate Serve Prepaid Card

Frequently Asked Questions

What are the Advantages of the OMF Brightway Card?

The OMF Brightway Card offers a scope of advantages, including cashback rewards, on-the-web and in-store payments, ATM withdrawals, and simple account management through the OMF portable application.

How long does it require to get the OMF Brightway Card?

When your application is accepted, it usually takes 5-7 working days for your OMF Brightway Card to reach you via the post office.

What documents do I have to give for the OMF Brightway Card?

To apply for the OMF Brightway Card, you should give a legitimate government-provided ID, confirmation of address, and verification of payment.

What charges are associated with the OMF Brightway Card?

There are no yearly expenses or month-to-month support charges related to the OMF Brightway Card. Be that as it may, there might be charges for specific services, like ATM withdrawals and foreign exchanges.

Conclusion

All in all, the OMF Brightway Card is a perfect choice for those searching for a hassle-free way to manage their money. Applying for the card is simple and clear, and the advantages and highlights of the card make it an extraordinary choice for many. By following the steps present above in this article, you can apply for and begin using your OMF Brightway Card right away.

Published On : July 3, 2023 by: Manisha Sharma/Category(s) : Master Card

Leave a Reply